how to calculate my paycheck in michigan

Calculating your Michigan state income tax is similar to the steps we listed on our Federal paycheck calculator. Michigan State has county level Withholding Tax.

Pchgames Free Online Games Sweepstakes And Prizes Instant Win Games Instant Win Win For Life

Total annual income Tax liability All deductions Withholdings Your annual paycheck.

. Back to Michigan Minimum Wage. If you think more than the maximum is being garnished from your paycheck you can object to the. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Michigan. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis. The unadjusted results ignore the holidays.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Michigan. Multiply the number of hours worked by the employees hourly pay rate. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Then add any other payments received during that week such.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. The number of dependents you support is an important component of your analysis as is the number of. Michigan Paycheck Calculator - SmartAsset.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Please view the updated EFT Credit Instructions for Michigan Business Taxes Form 2329 and go to Appendix A page 4 of the instructions to determine if the tax type you are making an EFT credit for in tax year 2015 has an updated financial institution account number.

Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions. Michigan allows employers to credit up to 573 in earned tips against an employees wages per hour which can result in a cash wage as low as 352 per hour. After a few seconds you will be provided with a full breakdown of the tax you are paying.

This free easy to use payroll calculator will calculate your take home pay. Supports hourly salary income and multiple pay frequencies. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount. Calculate your income and deductions based on what you expect for this year and use the current tax rates to determine your projected tax. How to Calculate Salary After Tax in Michigan in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status.

Switch to Michigan salary calculator. To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. How do I amend my state tax return.

The most popular methods of earning. Estimate your paycheck withholding with TurboTaxs free W-4 Withholding Calculator. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Enter your info to. Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

SmartAssets Michigan paycheck calculator shows your hourly and salary income after federal state and local taxes. Basically you can estimate payroll taxes different combinations of residencework area scenarios by using our payroll tax calculator online. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

Switch to Michigan hourly calculator. Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income. Gross wages represent the amount of money an employee has earned during the most recent pay period.

The calculator will automatically assume that the employer takes the maximum possible tip credit and calculate tip and cash wage earnings accordingly. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. You can calculate the taxes with Resident Location as Michigan and work location with all other 50 states.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

A creditor can garnish whichever is less. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Up to 25 of your disposable earnings OR The amount of your disposable earnings thats more than 30 times the federal minimum wage currently 21750 a week Read the article An Overview of Garnishment to learn about garnishments.

Michigan State tax calculator. Then use the withholding calculator on the IRS website to see the suggested withholding for your personal situation. Using our Michigan Salary Tax Calculator.

This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. The filing status affects the Federal and State tax tables.

Federal Payroll Taxes. Make sure to calculate any.

Here S The Salary Needed To Actually Take Home 100k In Every State Gobankingrates

Leo Can A Person Work Part Time And Still Collect Ui Benefits

Michigan Mi 529 Plans Fees Investment Options Features Smartasset Com

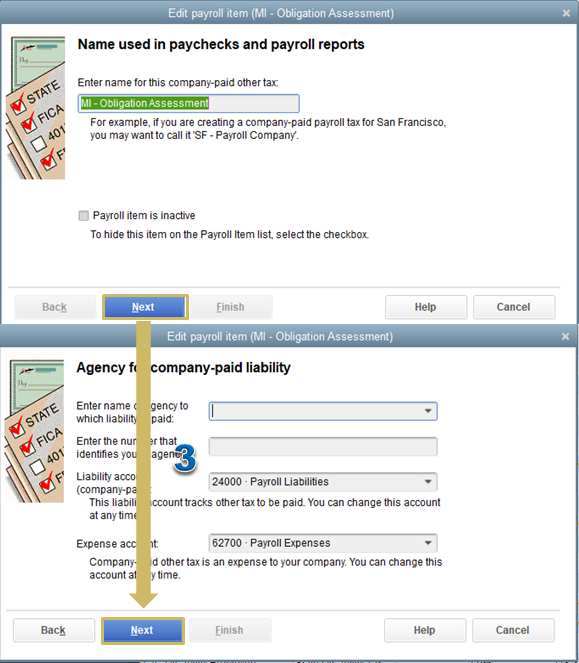

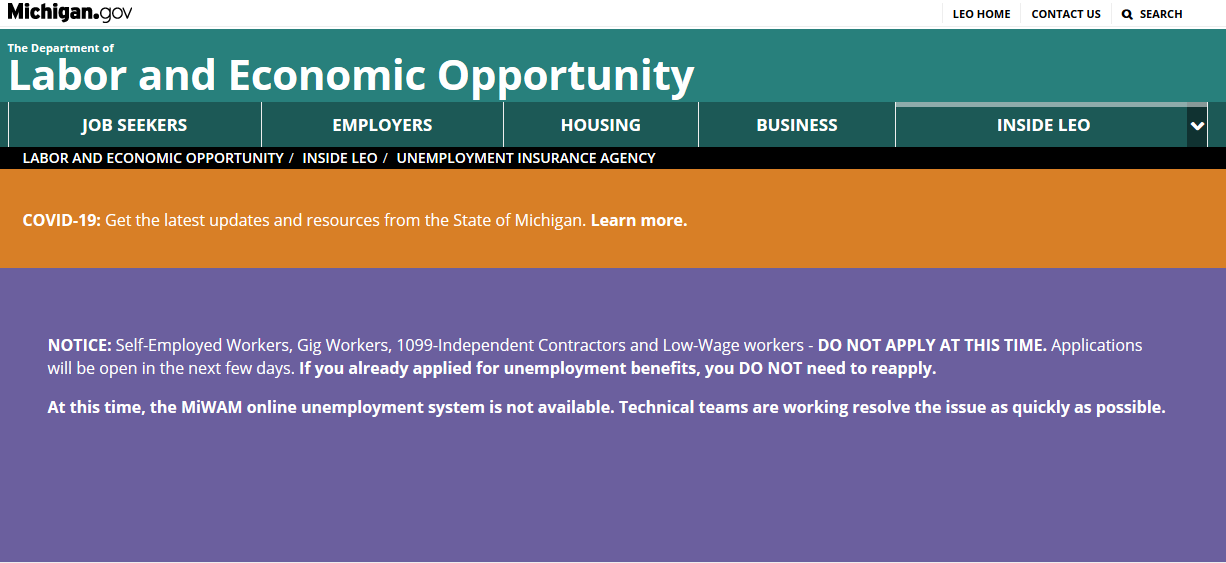

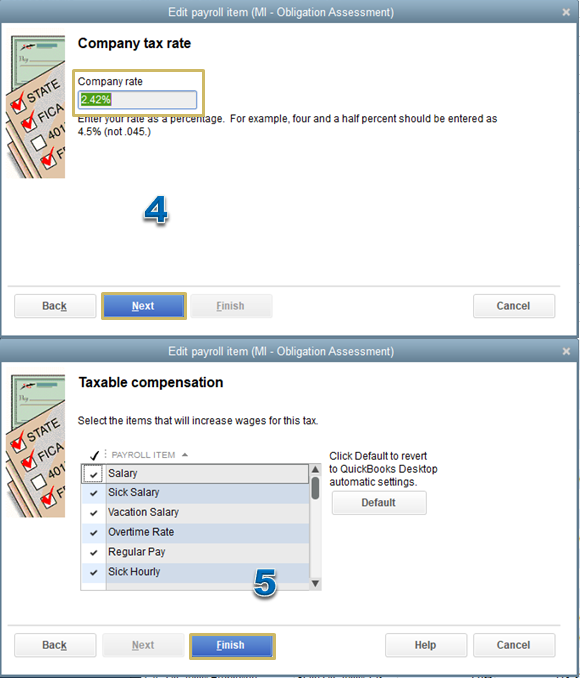

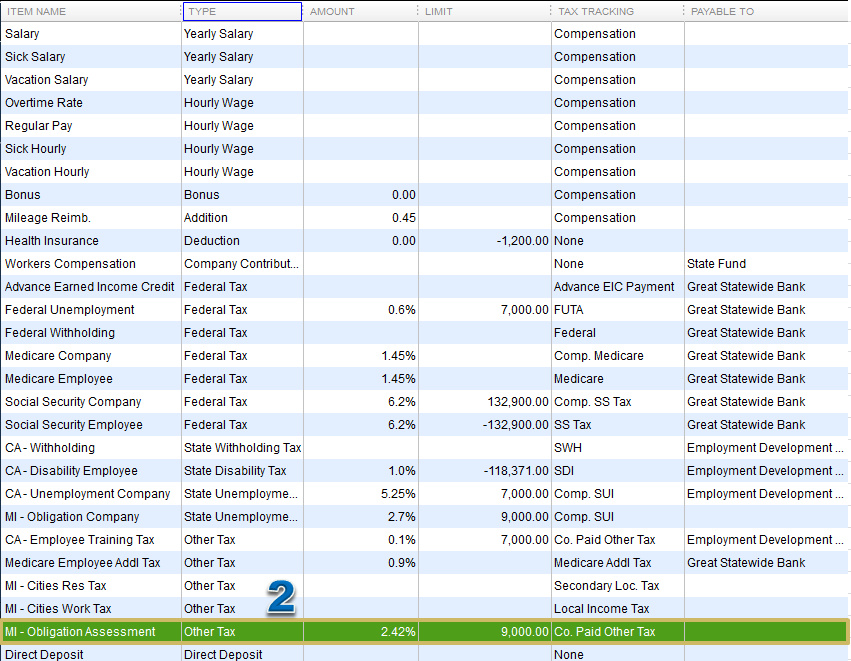

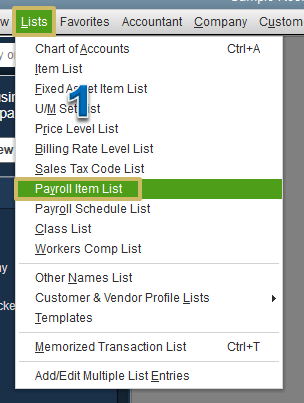

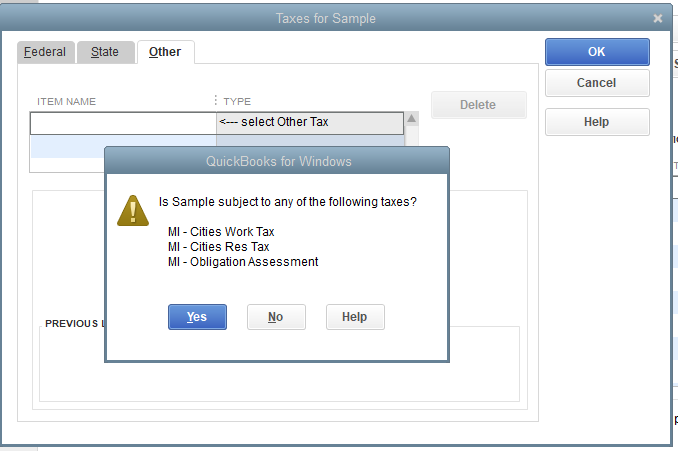

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Michigan Launches Afflicted Business Grant Program Foster Swift Collins Smith Jdsupra

Michigan Marvin Faq Michigan Unemployment Help Career Purgatory

Stop Hanging Around People Who Don T Want To Win Gary Vaynerchuk Gary Vaynerchuk Quotes Quotes Vaynerchuk

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Bond Falls Paradise Beautiful Waterfalls Waterfall Michigan

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

I Love You Math Quotes Really Funny Life Quotes

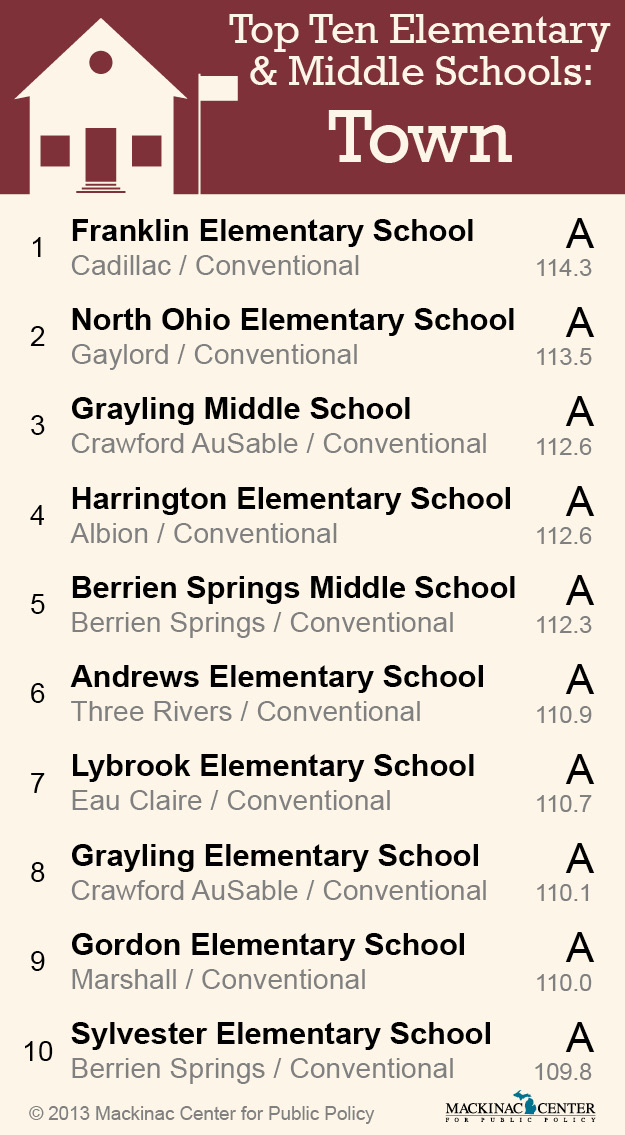

Top 10 Town Elementary And Middle Schools Michigan Capitol Confidential

Florida Snowbirds From Michigan Considerations In Choosing Your State Of Residence

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

Michigan City East Pier Lighthouse Michigan City Indiana Michigan City Indiana Michigan City Pictures Of Michigan